IRS eitc 11652 2021-2026 free printable template

Instructions and Help about IRS eitc 11652

How to edit IRS eitc 11652

How to fill out IRS eitc 11652

Latest updates to IRS eitc 11652

All You Need to Know About IRS eitc 11652

What is IRS eitc 11652?

When am I exempt from filling out this form?

Due date

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

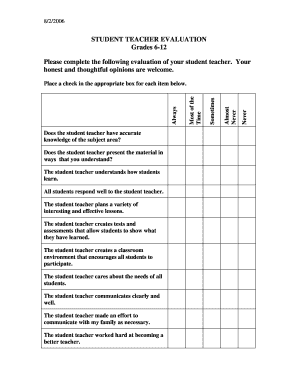

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS eitc 11652

What is the process for correcting errors on the IRS eitc 11652 after filing?

If you need to correct errors on your IRS eitc 11652 after submission, the best approach is to file an amended return using Form 1040-X. Ensure you provide accurate corrections and any necessary explanations. Always keep records of any communications and changes for future reference.

How can I track the status of my IRS eitc 11652 submission?

To verify the status of your IRS eitc 11652, you can use the IRS's 'Where's My Refund?' tool online. This service helps you check the receipt and processing of your submission and provides information on any delays or issues that may have arisen.

What documentation should I prepare if I receive a notice regarding my IRS eitc 11652?

If you receive a notice related to your IRS eitc 11652, it is essential to gather all pertinent documentation including your original submission, any supporting documents, and your personal identification information. This preparation will help you respond accurately to the IRS inquiries.

What are some common errors associated with the IRS eitc 11652, and how can they be avoided?

Common errors on the IRS eitc 11652 include incorrect personal information, miscalculating income, or failing to meet eligibility criteria. To avoid these pitfalls, double-check all entries against your documents and ensure you understand the qualifying conditions for the Earned Income Tax Credit.